By Trollgur Drek, Special Contributor

In a world teetering on the edge of economic uncertainty, where the stock market flutters like a leaf in a storm and whispers of recession echo through the streets, one would think that people would tighten their belts, perhaps even seek refuge in the safety of caution. But alas, what we see is quite the opposite. Humans, it seems, are spending their hard-earned money as if they’ve stumbled upon a never-ending gold mine. Even as the stock market dips, and even with the looming specter of a recession tied to the recent political chaos surrounding former President Donald Trump, people are flashing their cash with reckless abandon.

“Who cares about the economy?” one young shopper was overheard saying, as she confidently swiped her credit card for yet another extravagant purchase at a high-end fashion boutique. “I’ll just keep buying, no big deal!”

Indeed, across the nation, the sights and sounds of an ever-growing consumerist frenzy can be heard. From crowded malls to packed restaurants, humans are living large, ignoring the very warnings that might suggest a more prudent approach. Retail sales are up, luxury goods are flying off shelves, and credit card companies are grinning as they watch the charges rack up.

One might wonder how this could be happening while the stock market has taken a dive, and the economy sends its ominous signals. The answer, it seems, lies in a strange disconnect between financial reality and human behavior. Even with global markets shaken by the aftermath of political upheaval and the threat of an impending recession, humans seem determined to live as though their wallets will never run dry.

“People are living in a fantasy,” said one economist, shaking his head in disbelief. “The stock market has been volatile for months, Trump’s post-presidential legal battles continue to cause instability, and yet, people are acting as if the good times will never end. It’s a dangerous game.”

Despite the warnings, many humans seem impervious to the signs of economic trouble, instead opting for the immediate gratification of spending. The phenomenon, economists say, could be fueled by a blend of overconfidence, social pressure, and a complete disregard for long-term consequences.

In fact, according to recent reports, the rise of “inflated optimism” is often paired with the rise of “retail therapy,” a practice that has become all too common in today’s world. In a society that values instant gratification over financial security, it’s no wonder that so many are diving headfirst into the world of excess, as if their next paycheck could solve all their problems.

But not all humans are oblivious to the storm clouds gathering on the horizon. A small but growing number of people are trying to make sense of this madness, investing in more stable assets, saving for the future, and even turning to alternative forms of wealth—like good old-fashioned barter (or so they say, though I doubt many trolls would find that system very efficient). Yet, even among these more cautious individuals, the allure of easy credit and the temptation of flashy goods remains strong.

So what’s next for these wild-spending humans? Will they wake up to the dangers of their excess, or will they continue down the path of reckless abandon, oblivious to the economic storm that could sweep it all away?

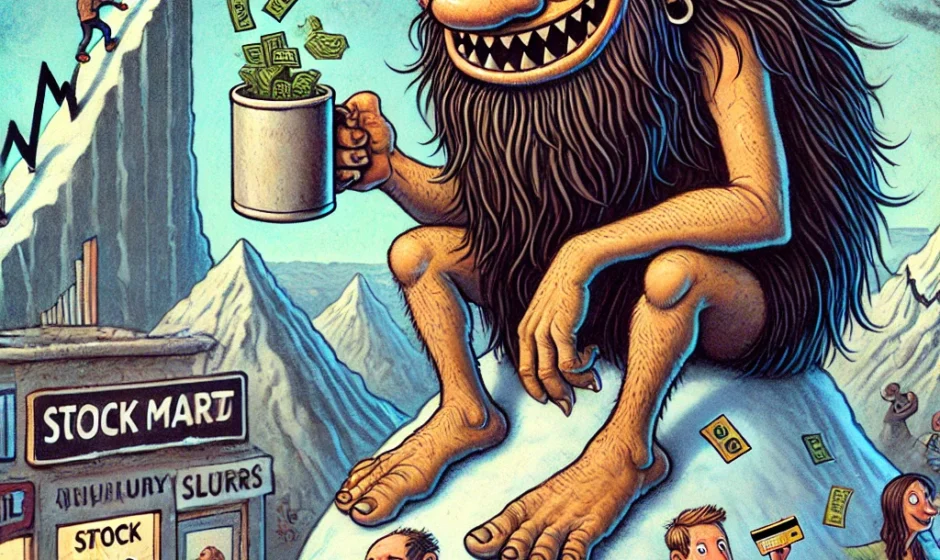

Only time will tell. But as this troll watches from his mountain, it’s hard not to chuckle at the irony. These humans, spending as though they were born with a fortune, seem to forget one crucial thing—the mountain always has a way of claiming what’s carelessly spent.

End of Article

Enjoy Endless Adventure and Explore the World on a Royal Caribbean Cruise! Book Royal Caribbean Cruises Today, Only at CruiseDirect.com!

The Trolls of Norway use Cruisedirect.com ‘cause it’s the only place that lets a nine-ton beast book a balcony suite without bein’ judged for bringin’ a herd o’ goats. And best of all, no hiking—just endless buffets, sunburned tourists to grumble at, and a hot tub big enough for a troll’s behind!

“Humans, always swiping cards like they’re collecting treasure. If only they knew, the mountain waits for those who waste their gold!”

“Ah, yes. Spend, spend, spend! Why save when you can have shiny things today and worries tomorrow? Brilliant strategy!”

“The storm’s coming, little ones. But don’t worry, when the wind blows, I’ll be sitting here with my mug, laughing at your shiny new gadgets.”

“Recession? What’s that? Oh, you mean the thing that happens when you throw all your coins into the wind? Sounds familiar.”

“You humans are like squirrels with acorns—except your acorns are all made of plastic and you have no idea winter’s coming!”

Speaking of economic uncertainty and human financial behaviors, you might be interested in exploring the concept of Behavioral Economics, which sheds light on why we often make less-than-rational financial choices. Additionally, learning about historical events like the Great Recession can offer valuable insights into economic crisis management and people’s spending habits during turbulent times. Lastly, if you were intrigued by the idea of impulse purchasing and emotional spending, reading more on Retail Therapy can provide fascinating perspectives into how shopping impacts our psychology and well-being.